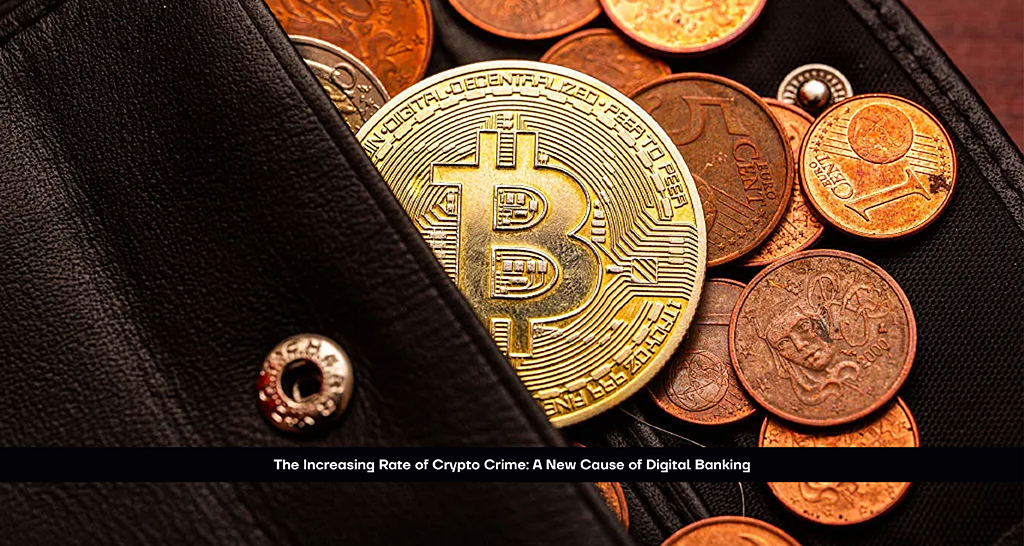

The growth of Bitcoin in today’s digital era is setting a new record. However, it demonstrates that more investors are moving away from their objective of being their own bank through tokens that can be transferred immediately outside the traditional banking infrastructure. At the same time, there is some awareness of the cost of being your own bank guard in the current cashless world.

In recent months, the quick raise in crypto-exchange hacks and a wave of brazen crypto-executive kidnapping attempts have put the whole industry on edge and created an issue in security, as per Bloomberg News. There have been 23 similar attacks recorded so far this year.

Although this issue came to light after one kidnapping attempt done recently in Paris this goes way beyond just one nation. Crime becomes broader everywhere. Today, banks are not easy targets for robbers. After heists are down over 80% since the 19990s branches are getting closed and piles of cash hoarded in safes become a rarity. Common people carry less cash for payments since they can easily tap and swipe now.

Hence, other forms of crime are becoming common. This hipe of digital wallets is attracting hackers to get client data; exchange hacks have increased to 17% last year as stated by the TRM.

The rise of attacks on cryptos holders is the next step, it is a symbolic return to the pre-banking days of highway Robber Dick Turpin. One social media slip-up can show your complete details to the criminals who are tech experts. According to the experts, the most likely result will be the demand for private security firms and stronger protection.